Easy to Find a Fast Direct Payday Loan: Your Ultimate Source for Speedy Financing

Easy to Find a Fast Direct Payday Loan: Your Ultimate Source for Speedy Financing

Blog Article

Secure Your Funds With a Straight Payday Advance Loan - Easy Application, Quick Disbursement

With a very easy application process and swift fund disbursement, these loans supply a quick way to secure your funds in times of unanticipated expenses. Prior to diving into the information of just how straight payday loans can be a viable choice, it is essential to recognize the nuances of this financial device and how it can be used efficiently to browse through economic uncertainties.

Advantages of Direct Payday Car Loans

Straight payday finances offer a convenient and effective way for individuals to accessibility quick money in times of economic requirement. In contrast, straight cash advance loans generally have marginal documents requirements and fast authorization times, enabling customers to secure funds quickly, often within the exact same day of application.

Moreover, direct payday advance supply adaptability in terms of usage. Consumers can utilize the funds for numerous objectives, such as covering unanticipated expenditures, clinical costs, auto repairs, and even consolidating financial debt. This flexibility gives individuals with the freedom to resolve their prompt financial concerns without limitations on how the funds must be spent.

Additionally, straight payday advance are obtainable to people with varying credit report. While conventional lending institutions might need a great credit report for funding approval, cash advance lending institutions often think about various other aspects, such as revenue and employment condition, making these finances a lot more comprehensive for individuals that might have less-than-perfect credit scores.

Application Refine Simplified

Simplifying the process for looking for cash advance can considerably boost the total customer experience and efficiency of getting financial help. To streamline the application procedure, direct payday advance service providers have accepted on-line systems, making it possible for consumers to finish the whole application from the comfort of their homes. The digital application types are made to be uncomplicated, calling for important information such as personal information, employment standing, income, and banking details.

In addition, to speed up the process, lots of direct payday advance lending institutions provide quick approval decisions, often within minutes of receiving the application. This swift turn-around time is crucial for people dealing with immediate monetary needs. In addition, the simplified application process minimizes the demand for substantial paperwork and documentation typically related to small business loan.

Fast Fund Dispensation

With the simplified application process in position, direct cash advance finance providers quickly pay out authorized funds to borrowers in demand of instant economic support. When a borrower's application is approved, the funds are typically paid out within the exact same company day, offering a fast solution to urgent monetary demands. This quick fund disbursement establishes direct payday advance loan apart from conventional bank fundings, where the approval and financing procedure can take several days or even weeks.

Additionally, the fast fund dispensation feature of direct payday car loans makes them a practical alternative for individuals facing monetary emergencies or unforeseen expenses. Whether it's a medical costs, auto repair service, or any various other urgent monetary need, customers can depend on straight cash advance for fast access to the funds they require to resolve pressing concerns.

Eligibility Criteria Introduction

Guaranteeing conformity with particular eligibility needs is essential when thinking about direct cash advance as an economic remedy. payday loans near me. To receive a direct payday advance, applicants commonly need to look at this web-site meet specific criteria established by the lending institution. Typical qualification requirements consist of being at least 18 years of ages, having a stable income, and possessing an energetic monitoring account. Lenders might likewise take into consideration the applicant's credit background, although a bad credit history does not constantly invalidate a specific from acquiring a payday advance.

Furthermore, some lending institutions might require consumers to provide proof of identification, such as a driver's certificate or state-issued ID, in addition to evidence of revenue, such as pay stubs or financial institution declarations. Satisfying these qualification standards is important to make sure a smooth application procedure and prompt disbursement of funds. Prior to obtaining a direct payday advance, people ought to meticulously assess the specific qualification demands of the lender to identify if they meet the required requirements. By recognizing and satisfying these requirements, debtors can boost their chances of approval and secure the economic support they need.

Responsible Loaning Practices

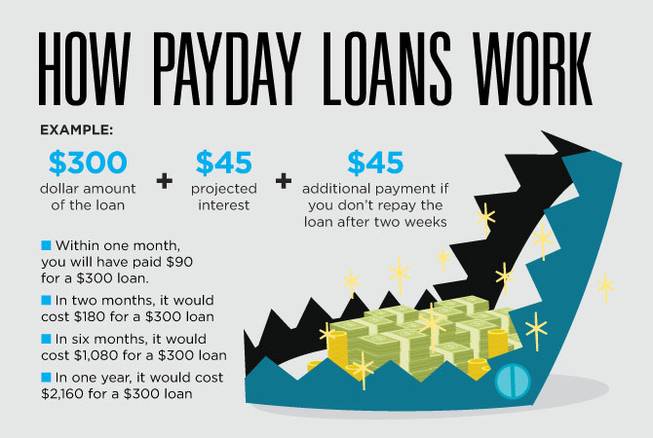

When engaging in borrowing tasks to guarantee long-lasting security and safety and security,Exercising financial prudence is important. Responsible loaning practices include a complete evaluation of one's economic situation before securing a direct payday lending. It is important to borrow just what is required and within one's ways to pay off conveniently. Focus on important expenses and emergencies over optional investing to stay clear of dropping right into a cycle of financial obligation. Understanding the terms and conditions of the finance contract is vital. Online payday loans. Be conscious of the rate of interest, costs, and payment timetable to make informed monetary choices.

Verdict

Finally, direct cash advance finances supply a hassle-free and effective solution for people in requirement of fast monetary aid. By streamlining the application process and giving quick fund dispensation, these car loans can aid debtors meet their instant financial needs. It is essential for consumers to follow liable borrowing practices to ensure their economic security over time.

Before diving right into the information of how straight payday car loans can be a practical choice, it is vital to understand the nuances of this economic device and exactly how it can be used efficiently current 30 year mortgage rates to browse via economic uncertainties.

Straight cash advance fundings use a convenient and efficient means for individuals to gain access to fast money in times of navigate to this site financial demand.With the simplified application process in place, straight cash advance financing providers promptly pay out accepted funds to customers in demand of instant economic help.Ensuring compliance with details eligibility requirements is critical when considering straight payday fundings as a monetary remedy.In conclusion, direct payday finances provide a convenient and reliable solution for individuals in demand of fast financial aid.

Report this page